When I first started learning about investing, I used to spend hours doing research.

Back then, I was working for myself, so my time was more flexible.

Now that I’m back in a full-time job, with way more obligations, and my obsession in moving my body every day, I prioritise exercising and going out and about instead of staying home and spend time searching for stocks.

So here’s what I do instead.

Disclaimer: This isn’t financial advice. Just a peek into how I sometimes approach stock research when I’m short on time.

Everyone’s financial situation is different. I’m just a late starter trying to build my portfolio. You still need to do your own due diligence and make sure what you buy aligns with your goals.

My short cut research routine

Quick stock chart scan

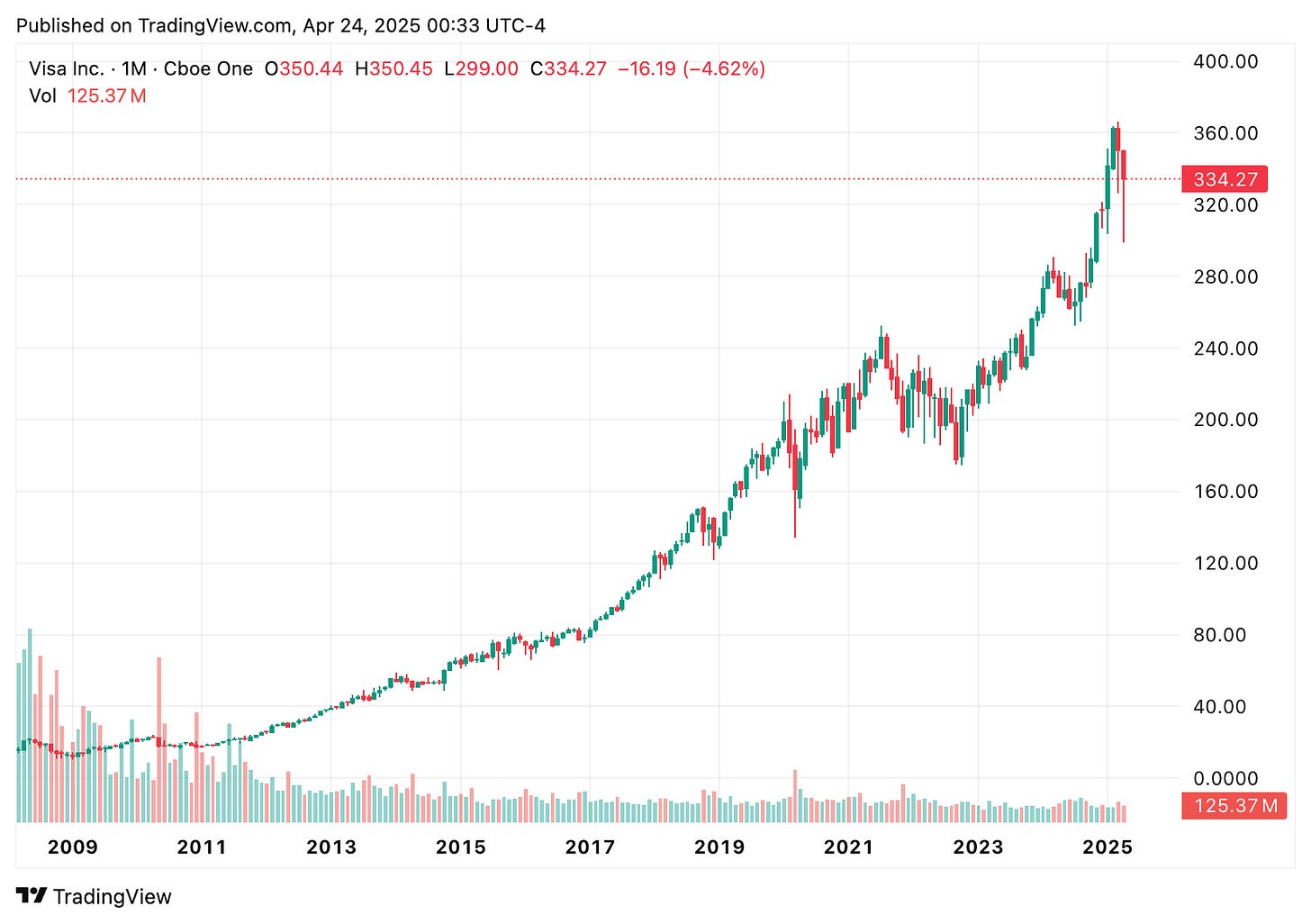

I learned to read charts a few years ago. I’m no expert, but I have a general idea about their patterns. So the first thing I do is zoom out and look at the stock’s performance since inception.

This helps me decide whether it’s something I even want in my portfolio.

And it really comes down to your strategy. For me, I’m risk-averse and looking for long-term investments.

Take Tesla, for example. Personally, I wouldn’t buy it. The chart is very volatile—it dances up and down in wide swings (from below $100 to over $480).

Now look at Visa. Despite the short-term fluctuations, it’s trending upward over time. That’s the kind of chart I’d be more comfortable with.

Again, that’s just me. Once I’ve done a quick chart check and like what I see, I move on to the next step.

Use AI to summarise the stock’s background

I ask ChatGPT (paid version) for a quick breakdown: historical performance, financials, any upcoming events that might impact revenue or get investors excited, and the risks I should be aware of.

Now—I don’t trust ChatGPT 100%. A lot of the info online can be inaccurate. But this gives me a general picture. If the chart looks good and I’m getting positive signs from my search, I move on.

Track stock price

This is where I look at the current price and decide on a comfortable price point to enter.

I use Fibonacci (Fib) Retracement to help identify potential price targets, then follow the stock’s movement.

If you don’t know what a Fibonacci line is, here’s a quick YouTube video I found:

As for tracking—it’s up to you. I’m old school and sometimes just jot it down in my notes or on a whiteboard.

How long I track for depends. If it’s trending upward and everything aligns—strong fundamentals, a steady chart—I’ll watch it for a week and then buy.

Read on the go

During my commute, I read articles or listen to podcasts. This is to give me an idea of what’s happening in the market.

Keep my deposit ready

Depending on your broker, transfers can take time—especially if you’re not in the U.S. and need to convert currency. You don’t want to miss an opportunity just because your funds haven’t cleared.

Some apps like Moomoo even pay interest on your idle cash, so I transfer funds in advance and they’re ready when I want to make a move.

Always use a limit order

I rarely buy at market price unless it’s already at the price I wanted.

Most of the time, I start with a lower offer and gradually adjust—like I’m negotiating with myself. If it doesn’t hit my target, I’m happy to pay a little more later.

The bottom line

Now, is this the most sophisticated strategy? Probably not.

But I’m a relatively conservative investor. I don’t chase shiny objects. I stick to large caps, long-standing companies, and ETFs.

Some stocks in my portfolio aren’t doing great—and that’s okay. That’s the nature of investing. You’ll have some winners and some losers. As long as my gains outweigh my losses, I’m happy.

You can absolutely take the traditional route—dig into financials, read the annual reports, and go full fundamental analysis mode. I’ve written about that in my beginner series before as that’s the best practice.

But don’t let “research” turn into paralysis.

This shortcut-style works for me, especially with my lifestyle. It gets me moving. And that’s the whole point—take action instead of waiting for the perfect method or the perfect time.

Should you follow exactly what I do? Probably not.

But you can take bits and pieces that work for you.

Build your confidence. Learn the ropes.

Then tweak your strategy from there.

Disclaimer: Information shared in this newsletter is not financial advice. Always do your own research before making any financial decisions.

If you think any of your friends will benefit from this post, please help me spread the word by clicking the “share” button below:

Nicely done, Sarina. I wouldn't buy Tesla either. Too much hype, but when pessimism sets in, people just won't stop dumping the stock.